Key Takeaways

-

Copayments may seem small, but they can add up quickly, leading to higher out-of-pocket costs than you anticipated.

-

Understanding how copayments work within your USPS health benefits can help you avoid unexpected expenses and make better financial decisions.

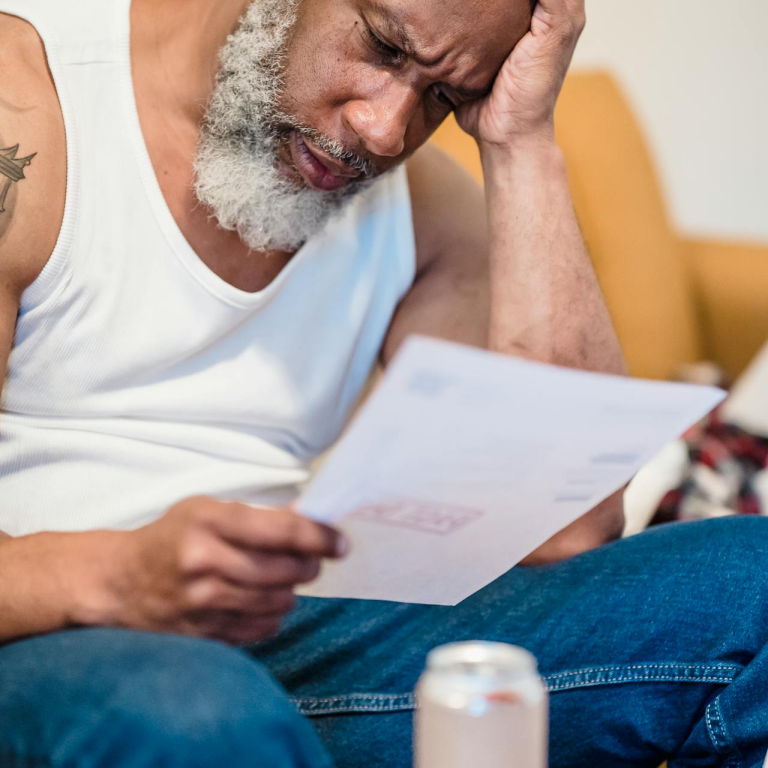

Copayments: The Sneaky Expense That Adds Up

When you think about healthcare costs, premiums and deductibles might be the first things that come to mind. But copayments—the fixed amounts you pay for doctor visits, prescriptions, and medical services—can often be the silent budget-breaker. For USPS employees, knowing how these costs impact your overall healthcare spending is crucial to making informed decisions about your coverage and care.

1. Frequent Visits Mean Frequent Payments

-

Routine doctor visits, specialist consultations, and urgent care visits all come with copayments.

-

If you or your dependents require frequent medical care, these costs can add up quickly.

-

Even a modest $30 copayment for a primary care visit can result in hundreds of dollars annually if you visit multiple times a year.

-

For chronic conditions requiring ongoing treatment, copayments can become a significant financial burden.

2. Prescription Copays Vary by Medication Tier

-

Most health plans have tiered prescription pricing, meaning copayments depend on whether a drug is generic, brand-name, or specialty.

-

Higher-tier medications typically have higher copays, sometimes exceeding $50 per prescription.

-

If your treatment requires long-term medication, the monthly copayments can significantly impact your budget.

-

It’s essential to check whether lower-cost alternatives exist to manage expenses more effectively.

3. Emergency Room Visits Come with High Copays

-

Emergency room (ER) visits usually carry higher copayments compared to urgent care or a doctor’s office.

-

These fees can range from $100 to several hundred dollars, depending on your plan.

-

If your condition isn’t life-threatening, considering urgent care or telehealth options could save you money.

-

Always verify your coverage details to avoid unexpected ER costs.

4. Specialist and Diagnostic Services Aren’t Cheap

-

Visiting a specialist often has a higher copayment than a primary care visit.

-

Diagnostic tests, like MRIs, CT scans, or bloodwork, may have separate copayments in addition to the office visit fee.

-

Some plans require a copayment for each service received in a single visit, quickly multiplying expenses.

-

Understanding which services are necessary versus optional can help reduce out-of-pocket costs.

5. Mental Health and Therapy Sessions Can Add Up

-

Many USPS employees seek mental health support, but therapy and psychiatric services often come with copayments.

-

Weekly therapy sessions, even at a moderate copayment rate, can add up to hundreds of dollars per year.

-

Some plans may limit covered visits, leaving you to pay the full cost once you exceed the allotted number.

-

Exploring in-network providers and covered alternatives can help reduce overall expenses.

6. Out-of-Network Providers Have Higher Copays (or None at All)

-

If you receive care from an out-of-network provider, your copayment may be significantly higher—or not apply at all, meaning you pay full price.

-

Some specialists or hospitals may not be covered under your network, leading to unexpected bills.

-

Always confirm whether a provider is in-network before scheduling appointments to avoid inflated costs.

-

In-network providers help you maximize your benefits and reduce unnecessary expenses.

7. Preventive Care Isn’t Always Fully Covered

-

While some preventive services have no copayments, others might require one depending on the type of test or screening.

-

Follow-up visits or additional tests resulting from a preventive screening may lead to unexpected copays.

-

It’s important to clarify with your healthcare provider which services are fully covered versus those that require out-of-pocket payments.

-

Taking advantage of covered screenings while being aware of potential follow-up costs can prevent surprise medical bills.

Making Smart Healthcare Choices to Reduce Copayment Costs

USPS employees can take several steps to minimize copayment-related expenses and keep healthcare costs under control:

-

Use In-Network Providers: Always confirm whether a doctor or specialist is in-network before booking an appointment.

-

Check Prescription Formulary Lists: Review your plan’s list of covered medications and ask about generic alternatives when possible.

-

Consider Telehealth Options: Virtual doctor visits often have lower copayments than in-person visits and can be a cost-effective alternative for minor concerns.

-

Plan Medical Visits Strategically: If multiple services are needed, try to schedule them within a single visit when possible to reduce cumulative copays.

-

Understand Plan Benefits: Review your USPS health plan annually to stay updated on copayment amounts and coverage details.

Avoiding Costly Surprises in Your Healthcare Expenses

Copayments may seem minor at first, but over time, they can become a significant financial burden, especially for USPS employees who rely on regular medical care. By staying informed about your health plan’s structure and making cost-conscious decisions, you can prevent unexpected expenses and manage your healthcare budget effectively.

If you need personalized guidance on optimizing your health coverage, get in touch with a licensed agent listed on this website for professional advice.