Key Takeaways

-

Transitioning from FEHB to PSHB in 2025 involves new processes and requirements for retirees. Understanding these changes ensures you maintain uninterrupted coverage.

-

Familiarize yourself with Medicare integration, enrollment periods, and cost considerations to make informed decisions.

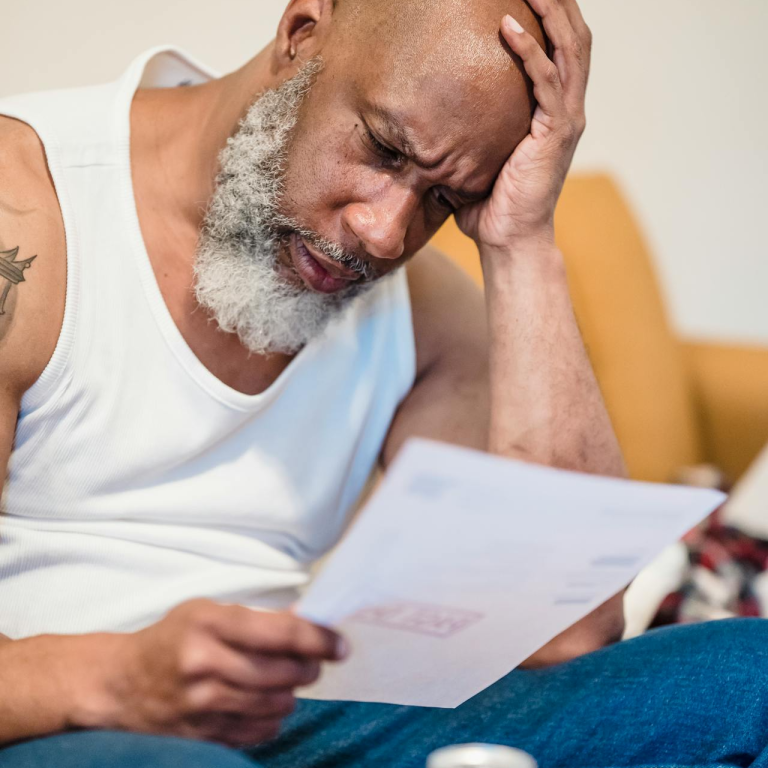

Adjusting to the PSHB Program: What Retirees Need to Know

If you’re a Postal Service retiree, the shift from Federal Employees Health Benefits (FEHB) to the Postal Service Health Benefits (PSHB) program marks a significant change in 2025. This transition may seem daunting, but understanding key details about enrollment and coverage ensures a smooth process. The change affects how retirees access healthcare services, the costs involved, and even the paperwork required for maintaining coverage.

Why the Change?

The switch from FEHB to PSHB aims to streamline healthcare options tailored to Postal Service employees and retirees. This dedicated program provides benefits specific to your needs while maintaining government contributions similar to FEHB. The PSHB program also integrates with Medicare for eligible retirees, offering potential cost savings and enhanced coverage. With this integration, retirees can access a wider network of providers and benefit from reduced out-of-pocket costs for major healthcare services.

Preparing for PSHB Enrollment

Know the Key Dates

The 2024 Open Season for PSHB enrollment ended on December 13, 2024. If you missed it, changes are only possible during Qualifying Life Events (QLEs) or future Open Seasons. Coverage under PSHB began on January 1, 2025. Keeping track of these dates ensures you don’t miss vital opportunities to adjust your healthcare plan.

Understand Medicare Requirements

If you’re Medicare-eligible, PSHB requires enrollment in Medicare Part B to maintain full coverage. Exceptions apply to retirees aged 64 or older as of January 1, 2025, who were not already enrolled in Part B. It’s essential to coordinate your Medicare benefits with PSHB to maximize savings. This coordination may include understanding how Medicare works alongside your PSHB plan to cover expenses like hospital stays, specialist visits, and prescription medications.

Navigating PSHB Coverage Options

Compare Plans

PSHB offers a range of plans tailored to different needs, with options including low-deductible and high-deductible plans. When comparing plans, consider:

-

Premiums and Deductibles: Balance monthly costs with out-of-pocket expenses to find the most cost-effective option for your healthcare needs.

-

Copayments and Coinsurance: Understand what you’ll pay for common services like primary care visits, specialist consultations, and prescriptions. Some plans offer lower copayments for routine care, making them ideal for retirees with regular medical appointments.

-

Provider Networks: Confirm your preferred doctors and hospitals are in-network to avoid higher costs. Using an out-of-network provider could lead to significantly higher expenses, even for minor treatments.

Evaluate Medicare Integration

For retirees enrolled in Medicare Part B, PSHB plans often waive deductibles and reduce copayments. Some plans also reimburse a portion of your Part B premiums, providing significant financial benefits. This reimbursement can make a considerable difference in your monthly budget, particularly if you’re managing chronic conditions that require frequent medical attention.

Steps to Secure Your PSHB Coverage

Check Your Current FEHB Plan

Review your FEHB plan details to understand how your benefits compare to PSHB options. Identify any gaps in coverage or cost changes that might affect your decision. For example, if your FEHB plan had extensive prescription drug coverage, confirm that your chosen PSHB plan offers equivalent or better benefits.

Use Online Tools

The PSHB program provides online resources to help you compare plans, calculate costs, and confirm provider participation. Make use of these tools to narrow down your options. These platforms often include interactive calculators and plan comparison charts to simplify your decision-making process.

Gather Required Documents

Ensure you have all necessary documentation ready, including:

-

Proof of Medicare Part B enrollment (if applicable).

-

Personal identification details.

-

Information about any dependents covered under your plan.

Having these documents organized ahead of time can save you from potential delays or issues during the enrollment process.

Handling Special Situations

Spousal Coverage

If your spouse is covered under your current FEHB plan, they can transition to a PSHB plan with you. However, if they’re eligible for their own FEHB coverage, they may choose to stay in that program. Discussing options with your spouse ensures you both choose plans that best suit your individual and shared healthcare needs.

Dealing with Qualifying Life Events (QLEs)

Life changes like marriage, divorce, or gaining a dependent allow you to make adjustments to your PSHB coverage outside Open Season. Be sure to act quickly, as these events typically have a 60-day window for changes. Missing this window could result in delayed or inadequate coverage for you or your dependents.

Maximizing Your PSHB Benefits

Leverage Preventive Care

Most PSHB plans emphasize preventive services, offering routine checkups and screenings at little to no cost. Regular preventive care helps you stay healthy and detect issues early, potentially reducing long-term healthcare expenses. These services often include vaccinations, annual wellness visits, and screenings for conditions like diabetes and high blood pressure.

Stay Informed About Plan Changes

Each year, PSHB plans may adjust benefits, premiums, and provider networks. Review your Annual Notice of Change (ANOC) letter to stay up-to-date and ensure your plan continues to meet your needs. This proactive approach allows you to switch plans during Open Season if necessary.

Explore Prescription Drug Coverage

PSHB plans include prescription drug benefits, often through Medicare Part D Employer Group Waiver Plans (EGWP). These plans cap annual out-of-pocket costs at $2,000, providing relief for high medication expenses. Understanding this cap can help you budget for your medication needs without unexpected financial strain.

Common Mistakes to Avoid

Missing Enrollment Deadlines

Failing to enroll during Open Season or missing a QLE window can leave you without coverage or force you into a less suitable plan. Mark key dates and act promptly to secure the best options. Set reminders or use a calendar app to keep track of important deadlines.

Overlooking Medicare Enrollment

If you’re required to enroll in Medicare Part B but fail to do so, you risk losing PSHB coverage or facing late enrollment penalties. Start the Medicare enrollment process early to avoid complications. Medicare’s integration with PSHB is crucial for comprehensive coverage, particularly for retirees with higher healthcare needs.

Ignoring Cost Comparisons

Premiums, deductibles, and out-of-pocket costs vary significantly across PSHB plans. Skipping a thorough comparison may result in higher expenses or inadequate coverage. Consider both short-term and long-term costs when choosing your plan.

Planning for Future Healthcare Needs

Anticipate Costs

Consider your expected healthcare needs, such as ongoing treatments or potential hospitalizations. Choose a plan that balances affordability with comprehensive coverage. Plans with lower premiums may seem appealing but could result in higher out-of-pocket costs if you require extensive medical care.

Save with an HSA or FSA

If your PSHB plan includes a high-deductible option, you may qualify for a Health Savings Account (HSA). These accounts allow you to set aside pre-tax funds for healthcare expenses, reducing your taxable income. Alternatively, Flexible Spending Accounts (FSAs) can help manage predictable medical costs. Both options provide tax advantages and can significantly reduce your overall healthcare expenses.

Maintaining Your PSHB Coverage

Monitor Premium Payments

For retirees, PSHB premiums are typically deducted from your annuity payments. Ensure sufficient funds are available to avoid lapses in coverage. If you notice any discrepancies, contact PSHB administrators promptly to resolve issues.

Update Personal Information

Keep your contact information current with PSHB administrators to receive important updates about your plan. This step ensures you don’t miss notifications about coverage changes, premium adjustments, or other essential details.

Review Coverage Annually

Your healthcare needs may change over time. Regularly reassess your PSHB plan during Open Season to confirm it aligns with your requirements. Don’t hesitate to switch plans if another option offers better benefits or lower costs.

Smooth Sailing into PSHB Coverage

Transitioning to PSHB from FEHB is a significant step, but with careful planning, you can navigate the process confidently. Understanding your options, meeting deadlines, and leveraging available benefits ensure you maintain seamless healthcare coverage as a Postal Service retiree. Taking the time to review your choices and make informed decisions will set you up for a stress-free transition.