Key Takeaways

- Understanding PSHB enrollment periods and deadlines is crucial for USPS employees to ensure they have continuous and comprehensive healthcare coverage.

- Knowing the key benefits of PSHB helps USPS workers make informed decisions about their health plan options.

Let’s Learn About Resources and Enrollment Guide for USPS Employees

Postal Service Health Benefits (PSHB) is a program tailored to meet the healthcare needs of United States Postal Service (USPS) employees. Navigating this program effectively requires understanding its resources, plan options, and enrollment processes. This guide aims to provide USPS employees with a detailed overview of PSHB resources and a step-by-step enrollment guide to help them make informed decisions about their healthcare coverage.

Essential PSHB Resources for Postal Workers

USPS employees have access to various resources that provide valuable information about PSHB. These resources are designed to help employees understand their healthcare options and navigate the enrollment process effectively.

-

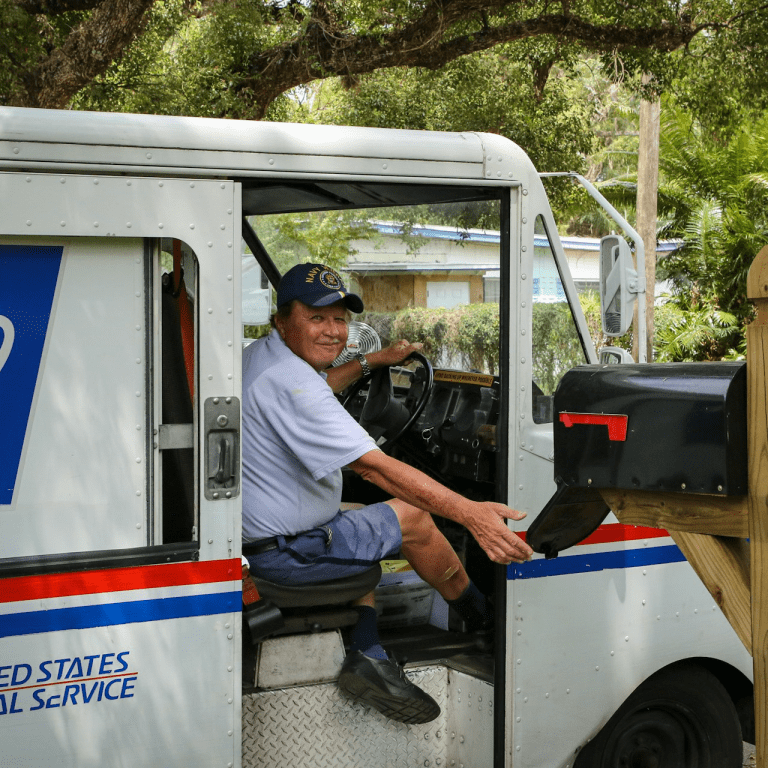

USPS Benefits Center: The USPS Benefits Center is a comprehensive source of information on PSHB plans, coverage options, and enrollment procedures. Employees can access plan brochures, comparison tools, and detailed guides to understand their benefits better.

-

Online Enrollment Platform: USPS offers an online enrollment platform that allows employees to review plan options, make changes to their coverage, and complete the enrollment process electronically. This platform is user-friendly and provides step-by-step instructions to ensure a smooth enrollment experience.

-

Human Resources (HR) Support: USPS HR representatives are available to assist employees with any questions or concerns related to PSHB. They can provide personalized guidance and help employees understand their options, ensuring that they make informed decisions about their healthcare coverage.

-

Licensed Insurance Agents: Consulting with a licensed insurance agent can be beneficial for employees who need more detailed information or personalized advice. Insurance agents can explain plan details, benefits, and costs, helping employees choose the best plan for their needs.

-

USPS and CMS Websites: Both the USPS and Centers for Medicare & Medicaid Services (CMS) websites offer extensive resources, including FAQs, policy documents, and informative articles. These websites are valuable tools for staying updated on any changes to the PSHB program and understanding how it integrates with other healthcare benefits.

Exploring PSHB Plan Options and Coverage

PSHB offers a variety of health plan options to cater to the diverse needs of USPS employees. Understanding these options and their coverage is essential for selecting the best plan for you and your family.

-

Health Maintenance Organizations (HMOs): HMOs provide a network of healthcare providers and facilities. Members typically need to choose a primary care physician (PCP) and get referrals for specialist services. HMOs usually have lower premiums and out-of-pocket costs but offer less flexibility in choosing providers.

-

Preferred Provider Organizations (PPOs): PPOs offer more flexibility in selecting healthcare providers. Members can see any doctor or specialist without a referral, though using in-network providers will result in lower costs. PPOs typically have higher premiums but provide greater freedom in healthcare choices.

-

High Deductible Health Plans (HDHPs): HDHPs have higher deductibles but lower premiums. These plans are often paired with Health Savings Accounts (HSAs), allowing members to save money tax-free for medical expenses. HDHPs are a good option for those who do not anticipate needing frequent medical care.

-

Point of Service (POS) Plans: POS plans combine features of HMOs and PPOs. Members can choose to use services within the network (like an HMO) or outside the network (like a PPO), with different cost structures for each.

Each of these plan options comes with its own set of benefits and trade-offs. USPS employees should consider their healthcare needs, budget, and personal preferences when choosing a plan. Reviewing plan details, such as premiums, deductibles, out-of-pocket costs, and additional benefits, is crucial for making an informed decision.

Step-by-Step Guide to PSHB Enrollment for USPS Employees

Enrolling in PSHB involves several steps, each critical to ensuring continuous healthcare coverage. Here’s a step-by-step guide to help USPS employees navigate the enrollment process:

-

Review Plan Options: Begin by reviewing the available PSHB plan options. Consider factors such as coverage, premiums, deductibles, and additional benefits to choose the plan that best meets your needs.

-

Gather Necessary Information: Have your personal information and employment details ready. This includes your USPS employee ID, Social Security number, and any relevant medical information.

-

Enroll During Open Season: The Open Season is the designated period each year when USPS employees can enroll in or make changes to their PSHB plans. This typically occurs in the fall, from mid-November to mid-December. Ensure you complete your enrollment during this time to avoid missing the deadline.

-

Qualifying Life Events: If you experience a qualifying life event (QLE) such as marriage, divorce, the birth of a child, or a change in employment status, you may be eligible for a Special Enrollment Period (SEP). This allows you to make changes to your health plan outside of the Open Season. Report the event promptly and update your coverage accordingly.

-

Initial Enrollment for New Employees: New USPS employees have an initial enrollment period within the first 60 days of employment. It’s crucial to enroll during this time to ensure that you have health coverage from the start of your employment.

-

Submit Your Enrollment: Complete the enrollment process by submitting your chosen plan through the designated USPS enrollment platform. Make sure to keep a copy of your enrollment confirmation for your records.

Important PSHB Enrollment Dates and Deadlines

Understanding the key dates and enrollment periods for PSHB is essential for maintaining continuous coverage. Missing these dates can lead to gaps in coverage or missed opportunities to switch plans. Here are the important periods to be aware of:

-

Open Season: The Open Season typically occurs in the fall, from mid-November to mid-December. During this time, USPS employees can enroll in or make changes to their PSHB plans for the upcoming year.

-

Qualifying Life Events (QLEs): If you experience a QLE, you have a limited time (usually 30-60 days) to make changes to your health plan. It’s important to report the event promptly and update your coverage accordingly.

-

Initial Enrollment Period: New USPS employees have 60 days from their start date to enroll in PSHB. Ensure that you complete your enrollment within this period to avoid any gaps in coverage.

-

Medicare Enrollment Periods: For USPS employees who are eligible for Medicare, understanding the coordination of benefits and the enrollment periods for Medicare Part B is crucial. Typically, you need to enroll in Medicare Part B during your Initial Enrollment Period, which starts three months before your 65th birthday and ends three months after it.

By adhering to these key dates and deadlines, USPS employees can ensure that they have continuous and comprehensive healthcare coverage.

Optimizing Your PSHB Benefits as a USPS Employee

To make the most of your PSHB benefits, it’s important to stay informed and proactive. Here are some tips to help you optimize your healthcare coverage:

-

Review Plan Details Annually: Health plans and coverage options can change annually. Review your plan details every year during the Open Season to ensure that your coverage meets your current healthcare needs.

-

Utilize Available Resources: Take advantage of the resources provided by the USPS Benefits Center, online enrollment platform, HR support, and licensed insurance agents. These resources can provide valuable information and assistance throughout the enrollment process and beyond.

-

Seek Professional Advice: If you have questions or need assistance navigating your health benefits, consider consulting a licensed insurance agent. They can provide personalized advice and help you make informed decisions about your healthcare coverage.

-

Understand Medicare Coordination: For employees who are eligible for Medicare, understanding how Medicare interacts with PSHB is essential for maximizing benefits and minimizing out-of-pocket costs. Ensure you enroll in Medicare Part B and understand the coordination of benefits.

By following these tips and utilizing the available resources, USPS employees can ensure that they make the most of their PSHB benefits and maintain continuous, comprehensive healthcare coverage.

Contact Information:

Email: [email protected]

Phone: 8135553456