Key Takeaways

-

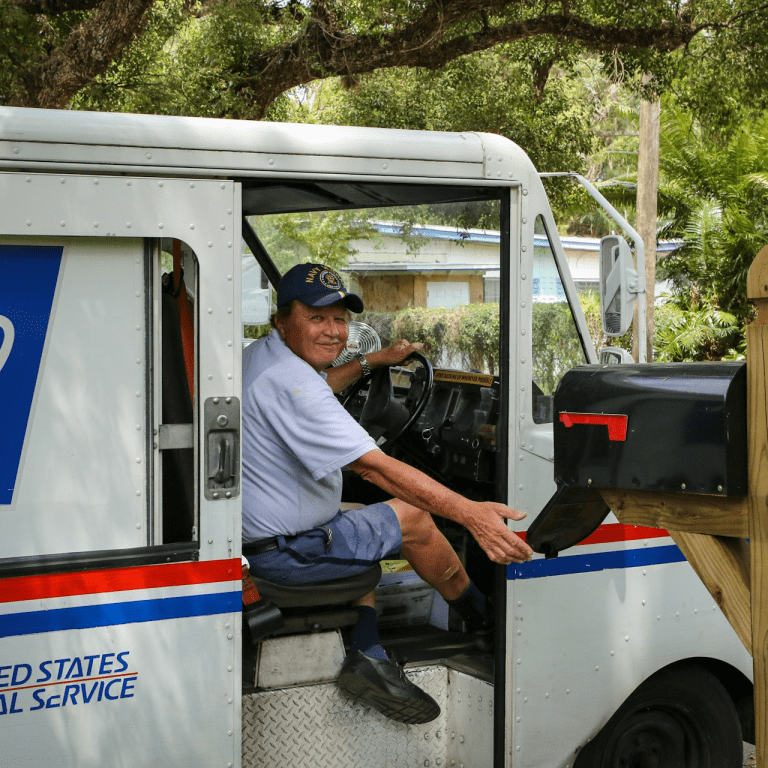

The 2025 Postal Service Health Benefits (PSHB) program provides tailored health coverage for USPS employees and retirees, ensuring seamless integration with Medicare for eligible members.

-

With simplified enrollment and cost-saving opportunities, PSHB helps you maximize benefits while addressing your healthcare needs effectively.

Understanding the 2025 PSHB Transition

The PSHB program officially replaces the Federal Employees Health Benefits (FEHB) system for USPS employees and retirees starting January 1, 2025. This change introduces health coverage specifically designed to meet the unique needs of postal workers and their families. If you’re a USPS employee or retiree, understanding these changes ensures you make the most of your benefits.

Why the Transition?

The shift to PSHB aligns with legislation aimed at creating a dedicated health benefits system for postal workers. The program streamlines coverage options and integrates Medicare for eligible enrollees, reducing redundancy and lowering costs. By focusing on the postal workforce, PSHB enhances affordability and plan choices.

Key Features of PSHB in 2025

Simplified Enrollment

The PSHB enrollment process makes it easier to manage your health coverage. If you were previously enrolled in an FEHB plan, you were automatically mapped to a corresponding PSHB plan during the 2024 Open Season. While auto-enrollment simplifies the transition, it’s still essential to review your plan details to confirm it meets your needs.

Comprehensive Coverage

PSHB plans include:

-

Hospital care

-

Doctor visits

-

Preventive services

-

Prescription drug coverage

Medicare-eligible retirees benefit from enhanced coverage through automatic enrollment in a Medicare Part D Employer Group Waiver Plan (EGWP). This integration simplifies prescription drug benefits and often results in lower out-of-pocket costs.

Cost-Effective Options

PSHB offers:

-

Government contributions toward premiums, reducing your overall costs.

-

Waived deductibles and cost-sharing for Medicare enrollees in some plans.

-

Reimbursement programs to offset Medicare Part B premiums in many cases.

How Medicare Fits into PSHB

If you’re Medicare-eligible, coordinating your PSHB coverage with Medicare Parts A and B enhances your benefits. Let’s break it down:

Medicare Enrollment Requirements

Medicare-eligible USPS retirees and family members must enroll in Medicare Part B to maintain PSHB coverage. Exceptions include those who retired before January 1, 2025, or reached age 64 or older by that date.

Benefits of Coordination

Combining Medicare with PSHB creates robust coverage. Medicare serves as your primary insurer, while your PSHB plan fills in the gaps. This arrangement reduces out-of-pocket costs and ensures you have access to a broad range of healthcare services.

Reviewing Your Plan

Understanding Your Annual Notice of Change (ANOC)

Each year, you receive an Annual Notice of Change (ANOC) detailing updates to your plan’s premiums, deductibles, copayments, and benefits. Reviewing this document ensures you stay informed about changes that might affect your coverage or costs.

Adjusting Your Plan During Open Season

The Open Season for 2025 coverage ended in December 2024. If you’re looking to make changes, you’ll need to wait for the next Open Season unless you experience a Qualifying Life Event (QLE) such as marriage, divorce, or a change in employment status.

How PSHB Saves You Money

Government Contributions

The federal government continues to cover a significant portion of your PSHB premiums, similar to the FEHB system. This contribution makes quality health insurance more accessible.

Integration with Medicare Part D

Automatic enrollment in a Medicare Part D EGWP ensures you receive prescription drug coverage tailored to your needs. Many plans also provide additional savings on medications, reducing the burden of high drug costs.

Financial Protections

For 2025, a $2,000 out-of-pocket cap for prescription drugs under Medicare Part D offers additional security. This cap eliminates the financial strain of high medication costs and provides predictable spending limits.

Addressing Common Questions

What If I’m Not Eligible for Medicare?

If you’re not eligible for Medicare, your PSHB plan provides comprehensive coverage similar to traditional FEHB plans. You’ll continue to receive hospital, medical, and prescription drug benefits.

Can I Keep My Current Doctor?

Most PSHB plans maintain extensive provider networks, ensuring you can access your preferred doctors and hospitals. It’s a good idea to confirm your provider’s participation when selecting a plan.

What Happens If I Missed the 2024 Open Season?

If you missed the Open Season, you’ll remain enrolled in your automatically assigned PSHB plan. Changes can only be made during the next Open Season or if you qualify for a Special Enrollment Period due to a QLE.

Making the Most of Your PSHB Benefits

Take Advantage of Preventive Services

PSHB plans emphasize preventive care, offering services such as annual checkups, screenings, and vaccinations at little to no cost. Staying proactive about your health helps you avoid more significant medical issues down the line.

Utilize Telehealth Services

Many PSHB plans include telehealth options, allowing you to consult with healthcare providers from the comfort of your home. This convenient service saves time and reduces the need for in-person visits.

Manage Your Prescriptions Efficiently

With the integration of Medicare Part D, managing prescriptions becomes easier. Use your plan’s mail-order pharmacy services to access medications conveniently and often at lower costs.

Planning for Future Open Seasons

Staying Prepared

The 2025 Open Season may have ended, but it’s never too early to start planning for the next one. Mark your calendar for October 15 to December 7 to explore your options and make changes if needed.

Assessing Your Needs

Take stock of your healthcare usage throughout the year. Are you happy with your current plan’s coverage and costs? Understanding your needs helps you make informed decisions during the next Open Season.

Your Role in Managing Health Benefits

Stay Informed

Keep an eye out for communications from your PSHB provider. Updates on benefits, coverage changes, and deadlines are crucial to managing your health insurance effectively.

Ask Questions

Don’t hesitate to contact your plan’s customer service team if you have questions or concerns. They’re there to help you navigate the complexities of health insurance.

Keep Records Organized

Maintain a file with all important documents related to your PSHB coverage, including your ANOC, enrollment confirmation, and Medicare information. This organization saves time and reduces stress when accessing or updating your benefits.

How PSHB Supports USPS Employees and Retirees

PSHB is tailored to the needs of the USPS workforce, recognizing the unique challenges postal workers face. The program simplifies access to high-quality healthcare while reducing costs and ensuring stability.

Reflecting on the 2025 PSHB Program

As you adapt to the new PSHB system, remember that its goal is to enhance your healthcare experience. From simplified enrollment to cost-effective integration with Medicare, PSHB represents a significant improvement for USPS employees and retirees. By staying informed and proactive, you can maximize your benefits and enjoy peace of mind knowing your health coverage is in good hands.